Watch the videos to learn more on how our bitcoin contracts work and how they can be used. Read the faq on our bitcoin options. The value of options on bitcoin futures is based on the regulated cme cf bitcoin reference rate brr and settles into actively traded bitcoin futures.

If you are looking to short bitcoin and believe that its price will go down over the option contract term then. If you are bullish on the price of bitcoin then you would consider opening a call option as this will allow you. Key terms in bitcoin options trading call.

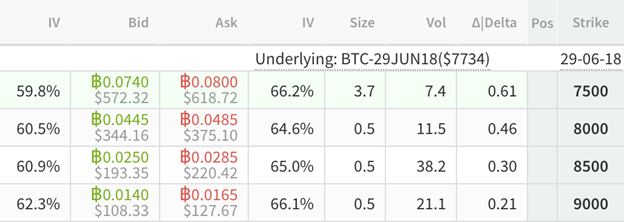

As bitcoin is such a volatile asset class vega has a significant impact on options pricing. A bitcoin option with a high theta will be closer to the expiration date vega measures the option s sensitivity to implied volatility in the underlying bitcoin market and how much the option s premium will change for every 1 change in volatility. In a fast moving market the maximum allowed spread can be double the required spread as for normal conditions.

Maximum spread for newly introduced series with an expiration date in less than 1 month can be 1 5 times the default max spread for the period of 1 day after the introduction of the new expiry. The largest batch of bitcoin options is set to expire june 26 both options and futures which are called derivatives are reaching a new all time high on the chicago mercantile exchange cme the. An option s strike.

Now let s discuss the strike prices of options on bitcoin futures. Cme group will list six consecutive. First let s look at the contract expirations.

Options on bitcoin futures expiration date and strike price understanding contract expirations. Today on june 26 bitcoin options worth 1 billion will expire with analysts divided on the consequent market impact. The btc options market has heated up in the past year with expiration dates becoming one of the most anticipated events throughout the year.

The cryptocurrency s options market.

Bitcoin options expiration date. Options contracts for roughly 67 000 bitcoin are expiring on july 31. In practice it could look like this. Bob buys a call option on bitcoin with a strike price of 7 000 on january 25 with an expiration on june 25. Since bitcoin is trading just above 9 000 bob would likely follow through with his buy order since his strike price what we would be paying for the bitcoin is 7 000.

Bitcoin options market faces record 1 billion expiry on friday bitcoin s btc derivatives continue to grow despite light spot trading over the past two months.

Bitcoin options market faces record 1 billion expiry on friday bitcoin s btc derivatives continue to grow despite light spot trading over the past two months. Since bitcoin is trading just above 9 000 bob would likely follow through with his buy order since his strike price what we would be paying for the bitcoin is 7 000. Bob buys a call option on bitcoin with a strike price of 7 000 on january 25 with an expiration on june 25.

In practice it could look like this. Options contracts for roughly 67 000 bitcoin are expiring on july 31.